Mergers and acquisitions (M&A) require accurate Purchase Price Allocation (PPA) to distribute the purchase price across acquired assets and liabilities. Goodwill represents the premium paid over the fair value of net identifiable assets.

For those looking to deepen their M&A knowledge, our PE Funds database, LBO model , and WSO Private Equity Elite Programme provide valuable insights.

Purchase Price Allocation (PPA) is an essential accounting procedure used during mergers and acquisitions to assign the purchase price paid for a target company to its various tangible and intangible assets and liabilities.

This process ensures that the financial statements of the acquiring company accurately reflect the value of the acquired entity. The goal of PPA is to allocate the purchase price to the acquired assets and assumed liabilities at their fair market value.

PPA is crucial in M&A for several reasons:

The main components involved in PPA include:

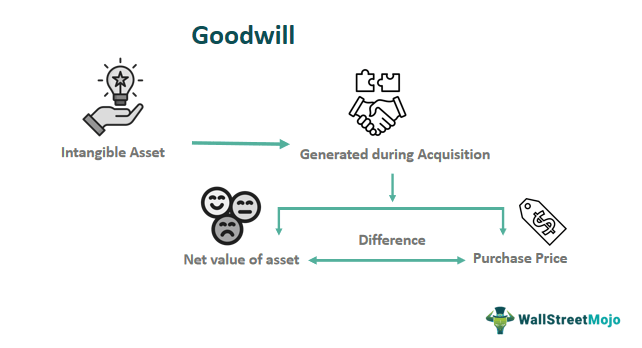

Goodwill represents the premium paid over the fair market value of the identifiable net assets of the acquired company. It reflects factors such as the acquired company’s reputation, customer relationships, and future earnings potential, which are highly valued during due diligence. Goodwill is recorded as an intangible asset on the balance sheet and is not amortized but tested annually for impairment.

This calculation is crucial in a business combination to accurately assess the equity involved. Goodwill is calculated using the formula:

Goodwill = Purchase Price – Fair Value of Net Identifiable Assets

For example, if a company is acquired for $100 million and the fair value of its identifiable net assets is $80 million, the goodwill would be $20 million. This situation is common in business combinations and must be handled carefully.

Several factors can influence the value of goodwill, including due diligence and accurate financial modelling.

A simplified example of Goodwill [Source: WallStreetMojo]

Identifiable intangible assets are those that can be separated from the acquired company and sold, transferred, licensed, rented, or exchanged. Examples include:

Valuing intangible assets involves estimating their fair market value, often requiring the expertise of valuation professionals. Common methods include:

Intangible assets can significantly impact the overall valuation of an acquisition, and should be carefully assessed during due diligence. Recognizing and valuing these assets accurately is crucial for reflecting the true value of the transaction and for subsequent financial reporting and tax purposes.

The process of allocating the purchase price involves several steps:

When allocating the purchase price, consider the following:

PPA affects financial statements in several ways:

Goodwill and other intangible assets are treated differently for tax purposes. Goodwill is generally not amortizable for tax purposes but is subject to annual impairment tests. Identifiable intangible assets can often be amortized over their useful life, providing tax deductions and enhancing the book value of the company.

The allocation of the purchase price affects tax reporting by determining the basis of assets and liabilities for tax purposes. Proper allocation can minimize tax liabilities by maximizing deductible expenses and appropriately categorizing assets, which aligns with GAAP standards.

Understanding Purchase Price Allocation (PPA) is essential for any professional involved in M&A, as it bridges the gap between deal valuation and post-acquisition financial reporting. A well-executed PPA ensures assets, liabilities, and goodwill are accurately represented, providing clarity to investors and compliance with accounting standards like ASC 805 and IFRS 3.

Beyond compliance, effective PPA can influence tax positions, earnings quality, and even the perceived success of an acquisition. By mastering how to evaluate tangible and intangible assets, allocate value efficiently, and interpret goodwill, finance professionals can better assess deal economics and create more transparent financial disclosures.

P.S. – don’t forget to check our Premium Resources where you will find valuable content to help you break into the industry!